property tax on leased car connecticut

Multiply the base monthly payment by your local tax rate. The Assessors Office values all vehicles at 70 percent of current market value using State recommended price guides and.

Snowball Developments Snowball Dev Twitter

2021 PROPERTY TAX CREDIT CALCULATOR.

. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a. One or both of the following statements apply. How to Calculate Connecticut Sales Tax on a Car.

If you do pay the personal property tax you can deduct it. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or dealer. Page 1 of 1 Mill Rates A mill rate is the rate thats used to calculate your property tax.

I leased the car in NY and when I did that NY sales tax was already calculated into my monthly payment. Leased and privately owned cars are subject to property taxes in Connecticut. In addition to taxes car purchases in Connecticut may be subject to other fees like registration title and plate fees.

170 rows Town Property Tax Information. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Office of Policy and Management.

If you own a Motor Vehicle in Connecticut on October 1 of any year you are liable for property tax on your motor vehicle. You or your spouse if filing a joint return are 65 years of age or. It is an annual assessment on personal property by the state and since BMWFS would own the car they would get the bill.

In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee most. Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. Its sometimes called a bank fee lease inception fee or administrative charge.

Like with any purchase the rules on when and how much sales tax youll pay. Yes you may take a credit against your 2016 Connecticut income tax liability for qualifying property tax payments you made to your Connecticut town or taxing district on your privately owned or leased motor vehicle or both. Quick question to any CT Lease holders or dealers.

You must be a Connecticut resident who paid qualifying property tax on the home andor motor vehicle AND. Fast forward 2 years and now Chase is sending me a property tax bill for the whole year of 2019 for the car. Thats higher than many other nearby cities.

No tiene Productos en su Cesta de la Compra. There are different mill rates for different towns and cities. Acquisition Fee Bank Fee.

2021 Property Tax Credit Calculator. Multiply the vehicle price after trade-ins but before incentives by the sales tax fee. Does BMWFS bill back the cost of the annual personal property tax in Connecticut to the lease holder.

The average effective property tax rate across Hartford County is 228 which is well above the 214 state average. To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. What are the requirements.

You can find these fees further down on the page. The acquisition fee will range from a few hundred dollars to as much a 1000 for a higher-end luxury car. And motor vehicle registration fees in New Hampshire.

This makes the total lease payment 74094. In the city of Hartford the mill rate is 7429 mills. The Connecticut Property Tax credit can be entered on your Connecticut return by following the steps below.

Motor Vehicles are subject to a local property tax. Paid qualifying property tax on your PRIMARY RESIDENCE ANDOR MOTOR VEHICLE during 2021 AND. Effective property tax rates in New Haven are the highest in the state of Connecticut.

The maximum credit allowed on your motor vehicle is 200 per return regardless of filing status. When you lease a vehicle the car dealer maintains ownership. I know this is considered a tax deduction.

Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract. According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales tax or 775 percent sales tax on vehicles over 50000 upon the purchase of your vehicle from a. A car lease acquisition cost is a fee charged by the lessor to set up the lease.

Excise taxes in Maine Massachusetts and Rhode Island. To be clear this is different than the sales tax on the sale of the car. For vehicles that are being rented or leased see see taxation of leases and rentals.

For example imagine you are purchasing a vehicle for 35000 with the state sales tax of 635. Sales tax is a part of buying and leasing cars in states that charge it. They are not subject to local taxes.

For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment. You may use this calculator to compute your Property Tax Credit if. Local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise.

You are a Connecticut resident AND. I called Chase and they are saying that the 20 dollar increase in monthly payment that I was paying was in fact for CT sales tax. The minimum is 635.

Used Cars For Sale In Berlin Ct Tasca Ford Berlin

Nj Car Sales Tax Everything You Need To Know

Used Cars For Sale In Berlin Ct Tasca Ford Berlin

Signature Auto Leasing Deals And Drive Car Lease Specials

Just Sold Harbor Freight Anchored Center Zebra

Used 2015 Chevrolet Suburban For Sale In Hartford Ct Edmunds

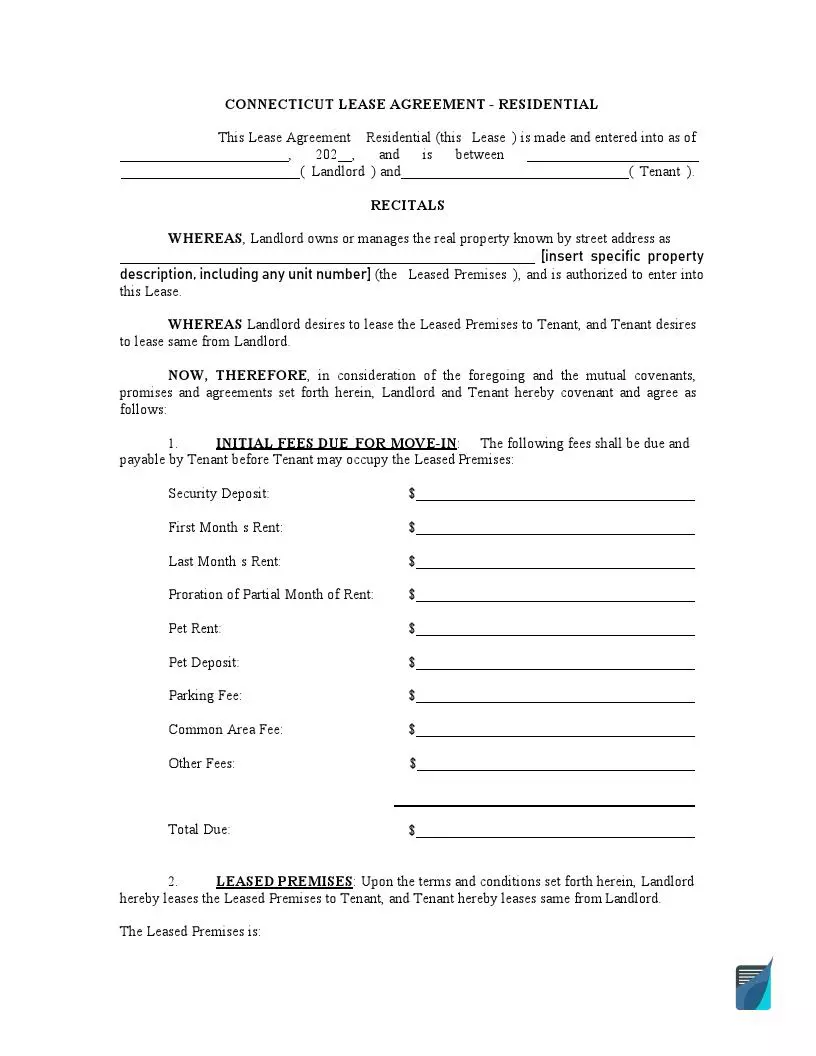

Free Connecticut Lease Agreement Forms Ct Rental Templates

Guide To Leasing A Car How It Works How Much It Costs

Used Cars For Sale In Berlin Ct Tasca Ford Berlin

Used Cars For Sale In Berlin Ct Tasca Ford Berlin

Used Cars For Sale In Berlin Ct Tasca Ford Berlin

2022 Bmw M4 Coupe Lease Deals 0 Down Specials Ny Nj Pa Ct

425 Post Road Fairfield Ct Office Building

Used Cars For Sale In Berlin Ct Tasca Ford Berlin